Roth Ira Limit 2024 Income Limits Contribution

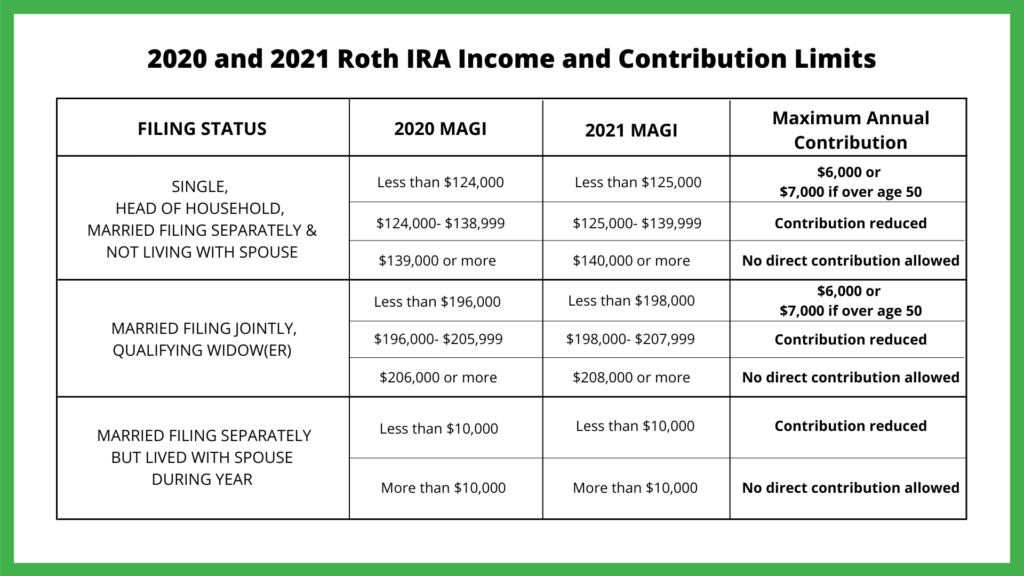

Roth Ira Limit 2024 Income Limits Contribution. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced.

The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or.

The Maximum Amount You Can Contribute To A Roth Ira In 2023 Is $6,500, Or $7,500 If You’re Age 50, Or Older.

The roth ira contribution limit for 2024 is $7,000, or $8,000 if you’re 50 or older.

The Ira Contribution Limits For 2024 Are $7,000 For Those Under Age 50, And $8,000 For Those Age 50 Or Older.

Roth iras are only available to single tax filers.

Roth Ira Limit 2024 Income Limits Contribution Images References :

Source: barbaraannewval.pages.dev

Source: barbaraannewval.pages.dev

2024 Roth Ira Limits Debi Mollie, 2024 roth ira contribution limits and income limits. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: esmeraldawtheda.pages.dev

Source: esmeraldawtheda.pages.dev

Roth 403b Max Contribution 2024 Veda Allegra, The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. If your employer offers a 401 (k), you can have.

Source: geniashaylah.pages.dev

Source: geniashaylah.pages.dev

Roth Ira Contribution Limits 2024 Capital Gains 2024 Taryn, The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. Single, head of household and married filing.

Source: mercishalna.pages.dev

Source: mercishalna.pages.dev

Roth Contribution Limits 2024 Irs Lizzy Margarete, Before funding your roth, contribute enough to your employer’s retirement plan to maximize any matching contributions. Learn about the roth ira income limits for 2024, including updates and strategies for maximizing your contributions and retirement savings.

Source: malindewedwina.pages.dev

Source: malindewedwina.pages.dev

Limits For Roth Ira Contributions 2024 Gnni Shauna, 2024 roth ira income limits. For 2023, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2023).

Source: devoramargarete.pages.dev

Source: devoramargarete.pages.dev

Agi Limit For Roth Ira Contribution 2024 Bessy Eleonora, You can leave amounts in your roth ira as long as you live. 2024 roth ira income limits.

Source: florindawailee.pages.dev

Source: florindawailee.pages.dev

Limits For Roth Ira Contributions 2024 Ursa Alexine, For 2024, a roth ira has a maximum yearly contribution limit of. For 2024, you can contribute up to $7,000 to a roth ira if you're under 50 and your income falls below the threshold.

Source: fredrikawbilli.pages.dev

Source: fredrikawbilli.pages.dev

Roth Contribution Limits 2024 Phase Out Renie Charmain, If your employer offers a 401 (k), you can have. For 2024, a roth ira has a maximum yearly contribution limit of.

Source: winniqgertrud.pages.dev

Source: winniqgertrud.pages.dev

Magi Limits 2024 For Roth Ira Letta Olimpia, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024. Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2024 Phase Out Ibby Cecilla, Your personal roth ira contribution limit, or eligibility to. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or.

Roth Contribution Limits 2024 Magi Enid Harmonia, The Total Overall 401 (K) Contribution Limit For 2024, Which Includes Employer Matching Contributions And.

Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on.

The Roth Ira Income Limits Will Increase In 2024.

Is your income ok for a roth ira?

Posted in 2024